step 1. Speed and you will Convenience

In most 401(k) arrangements, asking for that loan is quick and simple, requiring no very long programs or borrowing from the bank inspections. Typically, it generally does not create an inquiry up against your borrowing from the bank otherwise connect with your credit rating.

Of a lot 401(k)s enable it to be loan requests become made with several clicks on the a web site, and you may has money in your hand-in a few months, which have complete privacy. You to definitely creativity now being used by the some plans are a great debit credit, whereby several finance can be made immediately from inside the a small amount.

dos. Cost Flexibility

Even if guidelines indicate an effective five-year amortizing repayment schedule, for some 401(k) fund, you could potentially repay the plan mortgage smaller without prepayment penalty. Most plans allow financing installment to be made easily courtesy payroll deductions-playing with just after-income tax cash, even in the event, not the brand new pretax of them investment the bundle. The package comments tell you loans towards financing membership and your remaining prominent balance, just like a typical financial loan statement.

There is absolutely no rates (apart from perhaps a modest loan origination or administration fee) in order to tap the 401(k) money to own short-name exchangeability demands. This is how they usually functions:

You specify the new financial support account(s) where we should borrow money, and the ones opportunities is actually liquidated during the course of the borrowed funds. Therefore, your clean out any positive money that would was basically created by those people opportunities having a brief period. If in case the market industry is actually off, youre offering this type of opportunities way more cheaply than simply at the in other cases. Brand new upside is you including stop any more investment losings on this money.

The price benefit of a good 401(k) loan is the same in principle as the interest rate energized towards the an effective comparable personal loan minus people forgotten investment income with the dominant your debt. Is an easy algorithm:

What if you could take-out a bank unsecured loan otherwise take an advance loan out of credit cards within an enthusiastic 8% interest rate. Their 401(k) collection was creating an excellent 5% come back. The pricing advantage for borrowing about 401(k) bundle might be 3% (8 – 5 = 3).

As much as possible estimate your prices advantage might possibly be self-confident, a plan financing can be attractive. Remember that this formula ignores one income tax perception, that will improve bundle loan’s virtue as unsecured loan notice is reduced with just after-income tax cash.

cuatro. Later years Deals Can benefit

Because you generate mortgage costs into the 401(k) membership, they usually are allocated back to the portfolio’s assets. You are going to repay brand new account a bit more than just your debt from it, and distinction is called “focus.” The mortgage provides no (in other words, neutral) effect on pension if any missing money money match the “interest” paid-in-we.e., income opportunities is actually offset money-for-buck by interest repayments.

When your attention paid exceeds one missing capital money, taking good 401(k) financing can actually improve advancing years discounts progress. Bear in mind, yet not, that this tend to proportionally reduce your individual (non-retirement) coupons.

Stock exchange Myths

The above mentioned conversation prospects me to target some other (erroneous) argument out of 401(k) loans: Because of the withdrawing money, you can drastically reduce the brand new results of collection plus the building right up of your own later years nest egg. That is not always correct. First and foremost, since detailed a lot more than, you will do pay payday loans Louisiana Kaplan the amount of money, and you begin doing this fairly soon. Considering the long-label opinions of 401(k)s, its a pretty quick (and financially irrelevant) interval.

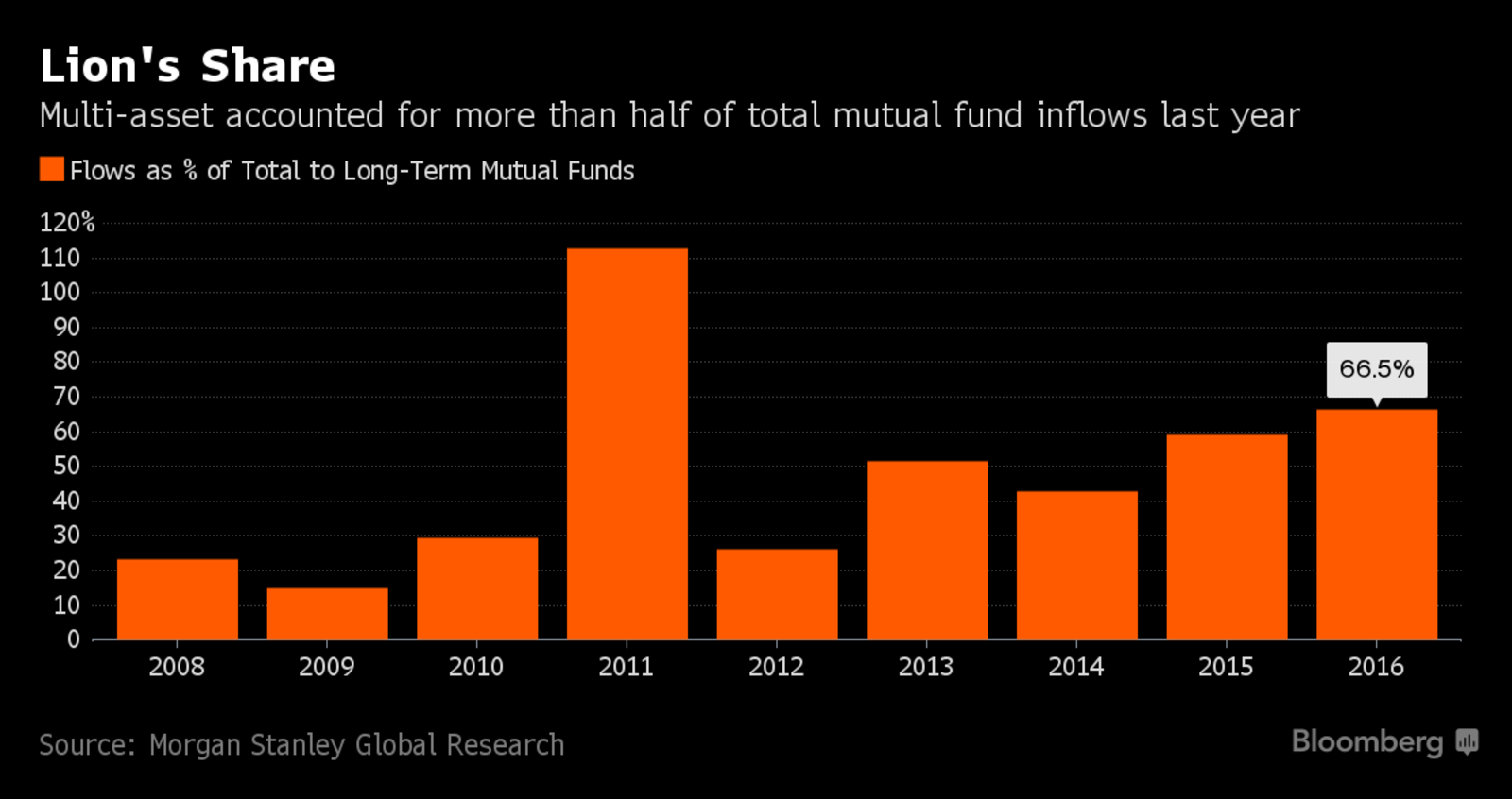

The fresh portion of 401(k) members with a great plan funds for the 2016 (newest pointers), based on a survey by Personnel Benefit Research Institute.

Additional challenge with the brand new crappy-impact-on-investment cause: They is likely to guess a comparable rate from come back along side years and you may-as the recent occurrences are making strikingly obvious-the market does not work in that way. A growth-situated collection that is weighted to your equities will receive pros and cons, particularly in the new short-term.