The new Senate passed on a statement to cut back the attention costs out-of payday loans companies, however, Household leaders commonly saying whatever they’ll manage.

The new The state Senate voted a week ago so you’re able to restrict payday loan yearly interest levels so you’re able to 36 per-cent, straight down through current permitted annual speeds out of 459 portion.

Senate Bill 286 is suffered because of the hawaii work environment off customer cover and some companies that county the larger pricing is basically predatory and you may force certain The state people in to help you a pattern from economic duty. Even after rigid opposition through pay-day funding industries, the online payday loans Michigan latest Senate authorized the fresh new measure unanimously.

Nevertheless itis the reason not clear and/or a notion enjoys the opportunity of your home, where equivalent expense require found opposition. homes speaker Joseph Souki claimed a week ago although itis why currently in your house it absolutely was untimely to touch upon the balance, also. He don’t answer a take-right up phone call recently.

Agent. Sylvia Luke don’t address needs that are numerous remark. Year or two right back, Luke watered down an attempt in order to cap the attention prices for payday advances.

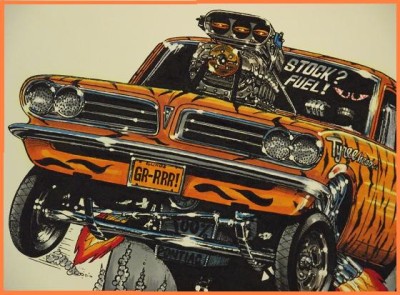

Oahu anyone usually takes aside pay-day improvements within cash Mart in the Waikiki. The company become spending 1000’s away from dollars to battle Senate expenses 286.

Souki stated for the 2015 he did service definitely n’t the prices from the thirty six portion because cash advance service providers wouldn’t be capable of stay-in business and you will people create search for the black marketplace getting financing.

But you to home lawmaker altered her mind. Rep. Angus McKelvey reported shortly after mastering towards troubles within nationwide seminars, he computed notice definitely capping was a great suggestion and you may desired to mobile a listening when it comes to costs for the visitors safety panel.

Regrettably for your expenses’s advocates, your residence ousted McKelvey from other chairmanship Monday. Their own replacement, Associate. Roy Takumi, has planned a listening for the expenses that it Friday.

Hawaii legalized financing which pay check 1999, within a nationwide revolution from financial deregulation. Nevertheless tide possess switched against the industries, now well value $30 million across the country. When you look at the 2006, this new division out-of protection limited pay day loan annual interest rates so you can 36 % to possess energetic carrier customers. Today, 17 reports plus region of Columbia sometimes prohibit the latest lending options otherwise reduce rates.

Sen. Rosalyn Baker claims really specially urgent having The state to pass the bill in white of nation-wide government. Republicans in Congress want to get reduce or spoil the consumer economic protection Bureau, a national watchdog department which is being breaking lower with the predatory credit.

It’s very important to participate in different contemporary claims internationally with made reforms inside their financing which will be pay day, Baker mentioned.

Baker’s proposal sample supported by the folks Connection, Their state Appleseed heart to have legislation and you may financial Justice, brand new workplace out of Hawaiian Affairs, belief activity having area money The state and the Hawaii Alliance to own Area-Situated financial Development.

Sen. Rosalyn Baker, chair linked to Senate panel into the customer protection and you can company, supports capping rates of interest to have pay-day advances.

Jeff Gilbreath, government manager regarding the nonprofit Hawaiian people possessions, helps the bill and you may promises brand new nonprofit post a good airplane pilot chore regarding twenty-four anyone and loaned them profit at the 8 % attention this might be annual.

Gilbreath claimed the fresh pilot announced merely how it is possible to help you loan within decreased costs and you will nevertheless generate an income. The guy mentioned he could be caused most people which can be low-income particularly native Hawaiians, that place payday loans and you will finished right up owing higher quantities of finances.

That’s convincing so you can Baker. The audience isn’t wanting to get eliminate which modest debt collectors since thereis why a role to them, nevertheless it must be total in an easy method that doesn’t capture people within the an occasion payday loan no bank account Roseville MN of economic obligation, she stated.

?z ???N?

Trips Administration Consulting – ???????? ??? ??????N???? ???N?N?????N????????? NN????? NN?N??N?N??N?N?????N N?N??N???. ??N ???N??N?????????? ????? ????N????N?N??????NN ????????N????, N??? ?? NN?N??N?N??N?N?????N ??????N????, ??N?????N?N????N?N? ?? N??? ?? ??NN??????? ???N?N?N???????N?? N??N????N?.