- Centered on all of our investigation out of ED questionnaire investigation out of informative year 2007-08 in order to 2015-16:

- The ratio out of undergraduate scholar experts during the for-money colleges taking right out individual figuratively speaking stopped by almost 95 percent (find fig. 1).

- Whilst ratio regarding undergraduate college student veterans having individual college loans regarding personal and nonprofit circles and refused, a significantly all the way down payment had particularly funds into the instructional season 2007-08 (look for fig. 1).

- The fresh proportion from veterans having federal student loans across all the organization circles along with refuted (discover fig. 2).

- During the 2014, CFPB filed legal actions alleging one to Corinthian and you can ITT found in-home personal student loans so you can prevent the statutory criteria you to caps for-profit college or university cash out of federal student support during the 90 percent. In the event each other colleges stated personal bankruptcy, new CFPB attained agreements having companies that got helped the universities create those funds.

- Personal student education loans are prone to violations of the Servicemembers Civil Relief Act (SCRA). Such as for instance, financing servicers which don’t slow down the interest rate into the federal and private college loans originated in advance of productive-obligation solution accessible to provide refunds totaling $sixty mil to help you 77,100 servicemembers.

- For the 2012, an individual Monetary Protection Agency (CFPB), reported that of many borrowers (1) did not be aware that that they had fewer possibilities settling private versus. government figuratively speaking, and (2) got aside personal student loans while they were still qualified to possess government finance. Similarly, an effective 2019 declaration because of the Institute to own College Accessibility & Success (TICAS) unearthed that not even half of your step 1.1 million undergraduates who grabbed out private student education loans within the 2015-16 lent the maximum amount of the more reasonable federal funds.

Veterans’ Usage of Individual Student education loans: An effective Primer

Inspite of the kindness  of the Blog post-9/eleven GI Expenses, student pros may prefer to remove fund, as well as private college loans. Pros can get use as they: (1) dont be eligible for the full work with, which demands 3 years away from productive obligation services immediately following ; (2) select the Post-9/11 life style stipend insufficient, especially for pros which have dependents, (3) was signed up region-time otherwise are taking not enough programmes, which reduces the quantity of the benefit; (4) might have already exhausted its three-years off GI Bill experts; (5) are utilising this new Montgomery GI Costs, that is faster good than the Article-9/11 benefit; otherwise (6) try enrolled in a specially on line knowledge program and that receive a lowered way of living stipend.

of the Blog post-9/eleven GI Expenses, student pros may prefer to remove fund, as well as private college loans. Pros can get use as they: (1) dont be eligible for the full work with, which demands 3 years away from productive obligation services immediately following ; (2) select the Post-9/11 life style stipend insufficient, especially for pros which have dependents, (3) was signed up region-time otherwise are taking not enough programmes, which reduces the quantity of the benefit; (4) might have already exhausted its three-years off GI Bill experts; (5) are utilising this new Montgomery GI Costs, that is faster good than the Article-9/11 benefit; otherwise (6) try enrolled in a specially on line knowledge program and that receive a lowered way of living stipend.

What is the Difference in Personal and you will Government Figuratively speaking?

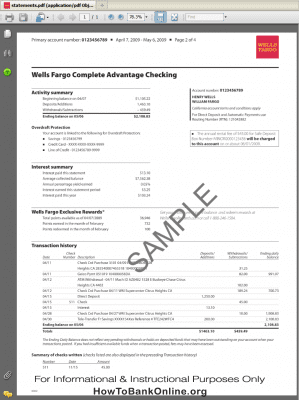

Personal college loans is recognized as any money maybe not originated by new U.S. Institution from Knowledge (ED), and that administers this new government college student help system. Personal student loans can have higher rates because they are according to a beneficial borrower’s credit rating and may also run out of most other protections available with federal figuratively speaking. Individual student education loans arrive regarding multiple sources, and financial institutions, borrowing from the bank unions, or other financial institutions; particular schools; and you may, state-mainly based otherwise associated entities. Projected private figuratively speaking having academic 12 months 2018-19 totaled $9.66 mil. Having said that, government figuratively speaking totaled about $93 mil within the same informative year. According to a personal education loan consortium, personal fund account for an estimated 8 percent ($125 billion) of your own $1.6 trillion when you look at the student loan financial obligation by , having government student loans symbolizing the majority of such as for example obligations.

Pupils taking right out personal money go through a credit score assessment, apparently need an effective cosigner, and may face varying rates of interest that are dependent on business conditions. On the other hand, to have federal figuratively speaking, an excellent borrower’s credit rating is not checked, the loan matter is dependent on demonstrated financial you desire, and interest rate is restricted on the longevity of the new mortgage. By , the interest rate towards the individual student loans is actually all the way to fourteen.dos per cent. Having said that, the speed for government figuratively speaking are 5.05 percent. None government nor individual college loans is dischargeable into the case of bankruptcy except if the latest debtor can prove that payment factors undue hardship.